Our company leverages global experience, outstanding expertise, and an extensive network to provide high value-added services, not limited to the UAE and Japan. Our compensation structure

is primarily based on performance fees determined by the value we provide and realize for our clients.

This approach prioritizes the establishment of long-term and mutually beneficial partnerships.

C&Y Inc.

Tokyo, Japan, 2008

HALLE Inc. Tokyo, Japan, 2018

Shibu Banking Consulting L.L.C.

Dubai, UAE, 2024

At SHIBU Banking Consulting, we pride ourselves on delivering expert advisory and support services to investors and corporations through our gatekeeper operations. This comprehensive approach involves developing tailored investment strategies, selecting and monitoring fund managers, managing risk, and optimizing asset portfolios to meet the unique needs of our clients.

More information

1

We create customized strategies based on clients' objectives and risk tolerance, analyzing market trends and economic indicators to optimize returns.

2

We identify top-performing fund managers and continuously monitor their performance to ensure that our clients' investments are always aligned with their goals.

3

We employ rigorous risk management techniques to analyze potential risks and propose effective mitigation strategies.

4

We manage post-investment cash flows efficiently, ensuring that our clients' financial resources are utilized optimally.

Expertise in Investment Consulting

Specialized knowledge in investment consulting and fund selection.

Enhanced Risk Management

Thorough risk analyses and tailored risk management strategies.

Extensive Network

Offering diverse investment opportunities through our network of fund managers and investors.

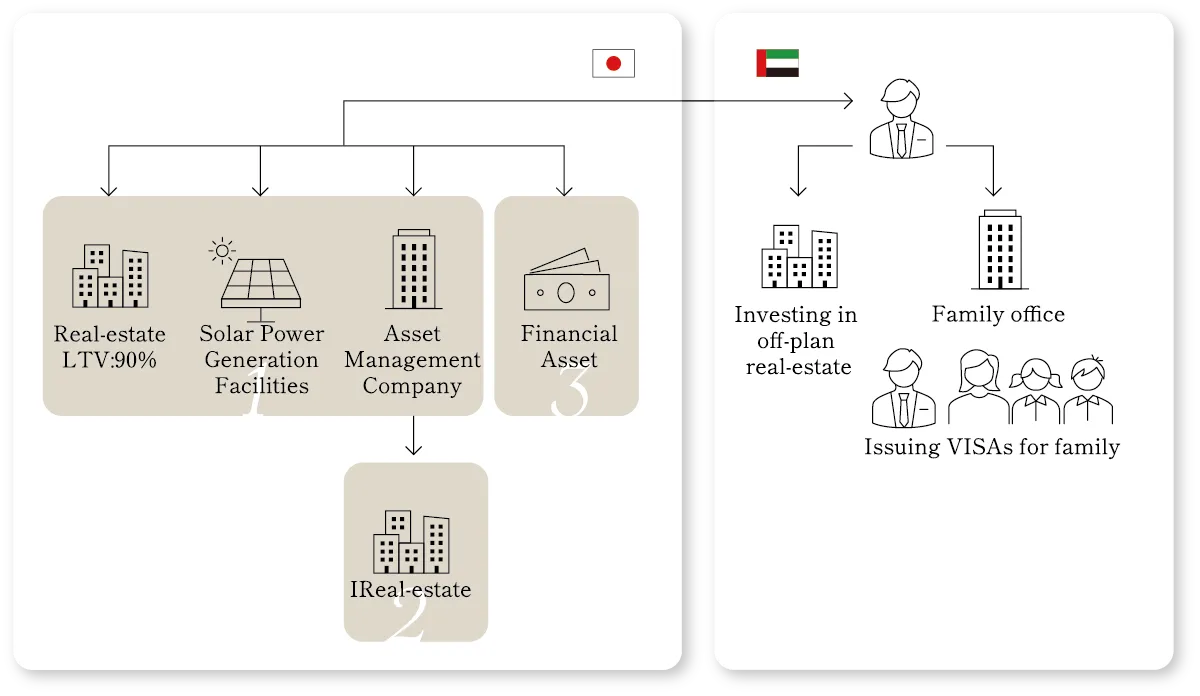

The client has built assets in Japan, including real estate, solar power facilities, and financial assets, and has decided to relocate to Dubai. In Dubai, they have purchased several properties and established a family office to issue visas for their family. Moving forward, they aim to enhance personal creditworthiness and actively engage in real estate investment by utilizing bank loans. They are also seeking advice on asset management in Japan and the development of an appropriate tax scheme.

More information

1

Delegated Japanese asset management to an affiliate, optimized tax efficiency using a Dubai entity, and established proper tax compliance and AML-compliant transfers.

2

Leveraged domestic property credit for high-yield Dubai real estate investments using low Japanese interest rates, diversifying client portfolios.

3

Secured overseas loans against U.S. securities, increasing leverage while mitigating forex risk, thus improving investment efficiency.

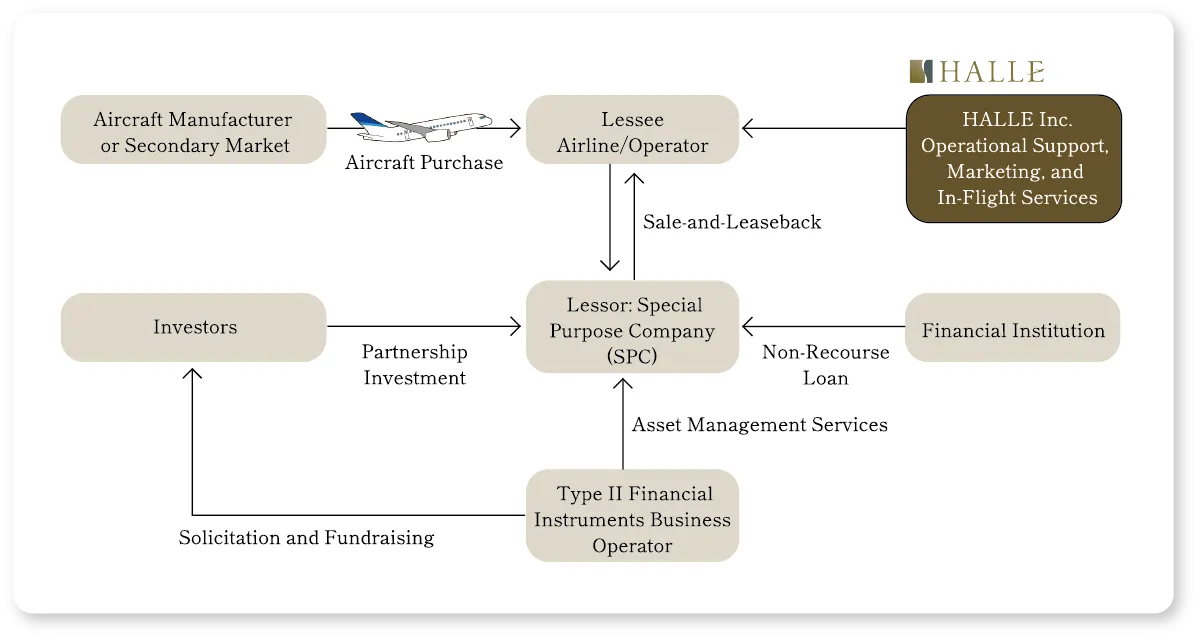

HALLE Corporation specializes in private jet-related services, offering comprehensive solutions for aircraft acquisition, sales, leasing, and support operations. In particular, we excel in aircraft acquisition by providing end-to-end support, including aircraft selection, scheme creation, and the structuring of aircraft financing. The attached diagram illustrates a JOLCO* scheme utilized for aircraft financing and operational management.In addition, we provide extensive support for aircraft charter services, including operational assistance, marketing support, and event organization to meet diverse customer needs. For aircraft operations, maintenance, and management, we collaborate with specialized companies through strategic alliances. We also oversee contract performance and offer accounting support to ensure smooth private jet operations.Furthermore, HALLE Corporation enhances the luxury travel experience by dispatching specially trained cabin attendants (CAs) and delivering high-quality in-flight services tailored to individual customer preferences. Our goal is to create a comfortable and exclusive journey for every client.*JOLCO (Japanese Operating Lease with Call Option) is a financing structure leveraging Japan's tax system. Under this scheme, Japanese investors purchase an aircraft and lease it to an operator. At the end of the lease term, the operator has the option to purchase the aircraft at a predetermined price. This structure is widely recognized as an efficient method of financing aircraft acquisitions.

More information

Our organization is dedicated to orchestrating innovative business models that drive revolutionary value creation while implementing comprehensive strategic risk management. This is

achieved through meticulous analysis of multifaceted macro environments and investment landscapes, encompassing demographic trends, economic indicators, industrial dynamics, regulatory

frameworks, and sovereign credit profiles.

While maintaining a global perspective, we prioritize cultural sensitivity and regional expertise, striving to gain an in-depth understanding of each client's unique circumstances and

aspirations. We facilitate the establishment of optimized investment foundations tailored to individual client needs, carefully considering international tax implications and fluctuations

in expected returns on investment.

Furthermore, we aim to forge unshakeable relationships of trust with our clients, pursuing long-term, sustainable value co-creation. This is accomplished by delivering asset portfolio

optimization grounded in rigorous scientific methodologies and providing investment guidance backed by cutting-edge expertise and market intelligence.

Our company adheres to a performance-based compensation structure that prioritizes client success, aligning our interests by sharing in revenue only after tangible client value has been

realized. This policy stems from our core belief that "our clients' success is the true measure of our own," and we are committed to remaining an organization that consistently evolves and

prospers in tandem with our esteemed clientele.

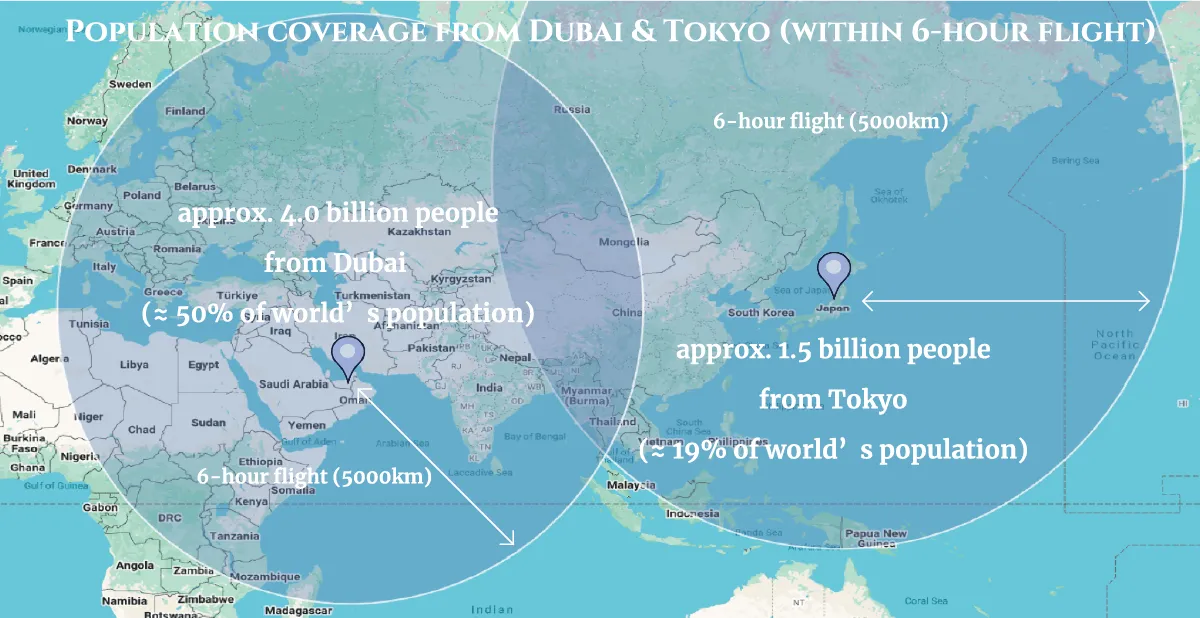

Dubai's strategic location links Europe, Asia and Africa, with almost half the world's population within a 6-hour flight (approximately 5,000km). Dubai International Airport (DXB) is one of the world's busiest, serving as a hub for multinational corporations and reinforcing Dubai's status as a leading international business centre.

After a career in strategy consulting and M&A financial advisory at PwC, IBM and KPMG, he joined All Nippon Airways (ANA) in 2008. During his tenure at ANA Holdings and its LCC subsidiary, Vanilla Air, he held various roles and contributed to management and corporate strategy. In 2015, he joined Mercuria Investment, a PE fund established by the Development Bank of Japan, where he focused on M&A projects and aircraft leasing fund initiatives. He then joined Kasumigaseki Capital in 2019, where he oversaw finance, corporate planning and investor relations. From 2023, he also served as CEO of a subsidiary in Dubai. In 2024, he established his own company, SHIBU Banking Consulting LLC, in Dubai, UAE.

Leveraging his extensive knowledge, experience and networks in finance and investment, he prioritizes client trust and provides comprehensive support in both proactive strategies and risk management. With a quality of service on a par with major institutions, he offers bespoke boutique-level solutions. With expertise spanning financial and corporate investments, real estate and even aircraft assets, he offers a uniquely broad range of advisory services.His book, The Invincible Global Asset: A Complete Guide to Aircraft Investment, offers clear insights into why the aircraft market continues to grow alongside the global economy, how investing in aircraft differs from investing in airline stocks, the compelling advantages over other tangible assets and which aircraft are ideal for investment.

Company Name

SHIBU BANKING CONSULTING L.L.C

Headquarters / Address

Office No. OFMZ02-70, ARIF & BINTOAK BUILDING,

Bur Dubai, Al Karama, Dubai, 231381, UAE

Tel: +971 50 380 5838

Founded / Establishment Date

April 23, 2024

Representative

Yuichi Shibuta

Licenses / Certifications

Dubai Economy and Tourism License No.: 1343269